Annual

Report

2024

Year in brief

Focus

Continued organisational improvements with focus on members’ needs

Global market

Strengthened global market position through ongoing strategic adjustments

Strong results

Achieved strong insurance results backed by solid investment performance

Confirmed rating

Maintained strong financial position, confirmed by rating agencies

Enhanced product offering

Delivered innovative solutions and enhanced product offerings to members

In 2024, we demonstrated our resilience and strategic foresight in navigating an increasingly complex market environment.

Thomas Nordberg, Managing Director

Financial highlights

Calls and Premiums

$243.8m

2023: $242.6m

2022: $229.7m

Reinsurance Premiums

$59.8m

2023: $56.5m

2022: $56.6m

Net Claims Incurred

$143.1m

2023: $147.0m

2022: $136.9m

Investment Results

$28.8m

2023: $34.0m

2022: $-38.2m

Operating Result

$34.0m

2023: $30.0m

2022: $-41.7m

Free Reserves at year end

$216.6m

2023: $183.7m

2022: $150.0m

Expense Ratio

21%

2023: 20%

2022: 21%

Combined Ratio

98%

2023: 102%

2022: 102%

Loss Ratio

77%

2023: 82%

2022: 81%

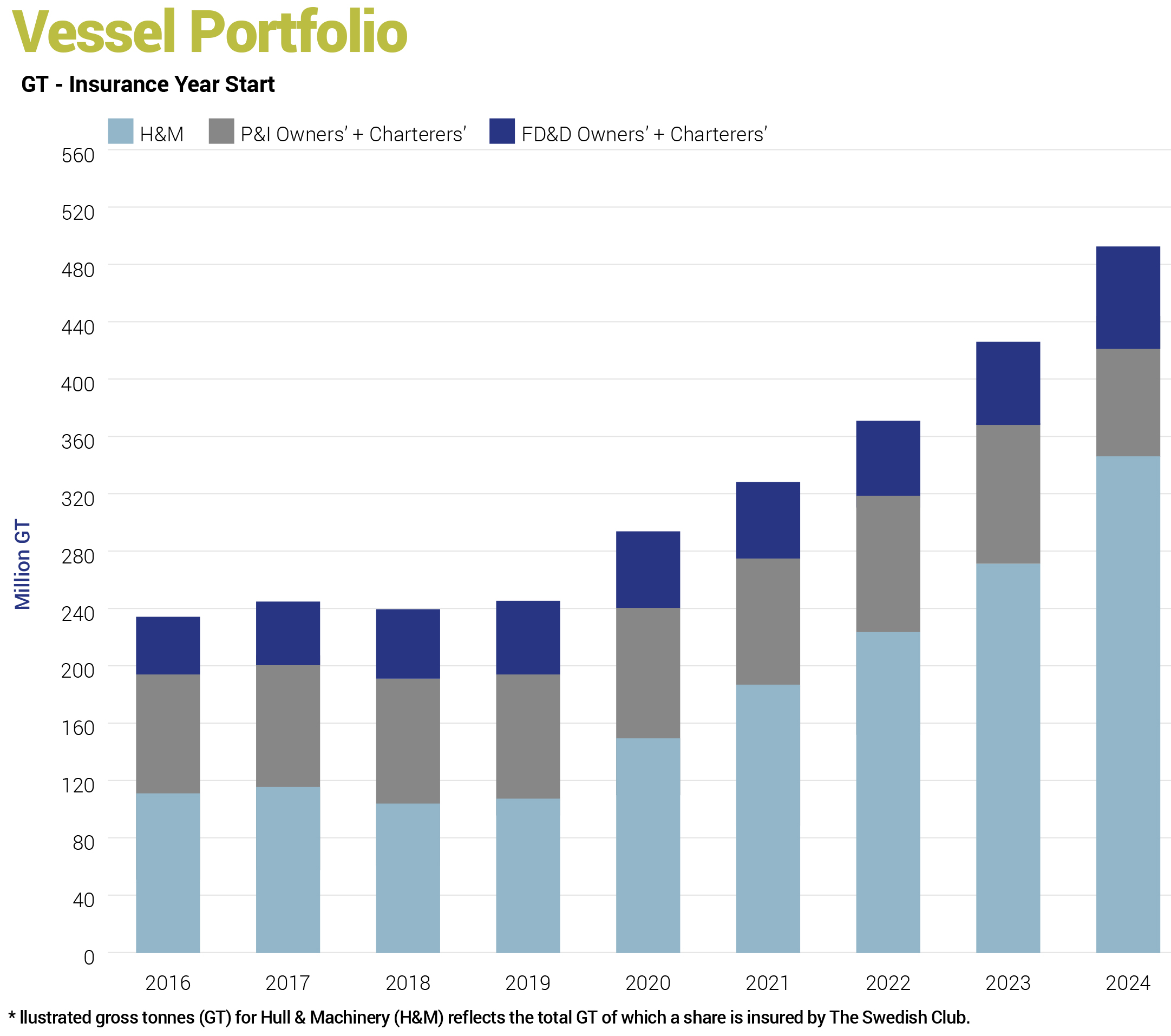

Vessel portfolio

At a glance

P&I Insurance including Charterers’ Liability – February 20

| Insurance Facts | 2025 | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|---|

| No. of vessels | 2,224 | 2,248 | 2,437 | 2,375 | 2,230 |

| Gross tonnage (million) | 86,9 | 88 | 93 | 92 | 88 |

FD&D Insurance – February 20

| Insurance Facts | 2025 | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|---|

| No. of vessels | 1,375 | 1,309 | 1,651 | 1,443 | 1,317 |

Marine H&M Insurance including OSVs – January 1

| Insurance Facts | 2025 | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|---|

| No. of vessels | 6,736 | 6,116 | 5,237 | 4,780 | 3,999 |

| Insurance value (USD million) | 261,100 | 217,100 | 188,100 | 154,500 | 106,542 |

| Of which the Club has insured (USD million) | 27,200 | 23,500 | 22,600 | 19,500 | 13,800 |

ESG

Sustainability report

The Swedish Club’s purpose is to provide marine insurance to shipowners and other ship operators worldwide. The liability insurance (P&I) provided by the Club, and through the Club’s reinsurance arrangements, is a key factor in enabling world seaborne trade, protecting the marine environment, and providing compensation to legitimate victims of maritime accidents. Therefore, the Club’s core business is vital in supporting a well-functioning and sustainable society.

As an insurance company, the Club is subject to stringent regulatory requirements, which prompts equally stringent regulatory compliance. Sound business practices and stability in the operations are safeguarded by robust processes for internal control and a holistic enterprise risk management system. This system is carried out through a control cycle that involves the systematic identification, valuation, monitoring and reporting of all existing and emerging risks.